Chargebacks

Explanation of and how to handle chargebacks

What is a Chargeback?

When a customer does not recognise a transaction, they can lodge a dispute with their bank. If this occurs, Ezypay will be notified and asked to provide supporting documents which the bank uses to decide if a credit is due to the customer. This type of credit is called a chargeback.

When a transaction is disputed on a master card or visa card transaction, the card schemes (Master Card and Visa Card) will always favour the customer regardless of documents provided.

This does not mean the customer does not owe you or your business any moneys, it just means that it can’t be deducted from that card any more and prior transactions may be returned to the customer and will be deducted from your upcoming settlement.

You may pursue the customer for these funds via direct communication with the customer, small claims court or debt collection.

When a dispute is raised by a customer that made a card payment or bank debit payment, the amount disputed (including any fees) will be deducted from your next available settlement. If the dispute is dropped by the customer or the case dismissed by the bank, Ezypay will return these funds in your next settlement. In this scenario, any adjustments made to your settlement will be visible in the settlement report as a Chargeback (for the initial deduction) and Chargeback Reversal (for a credit) if the funds are returned to you.

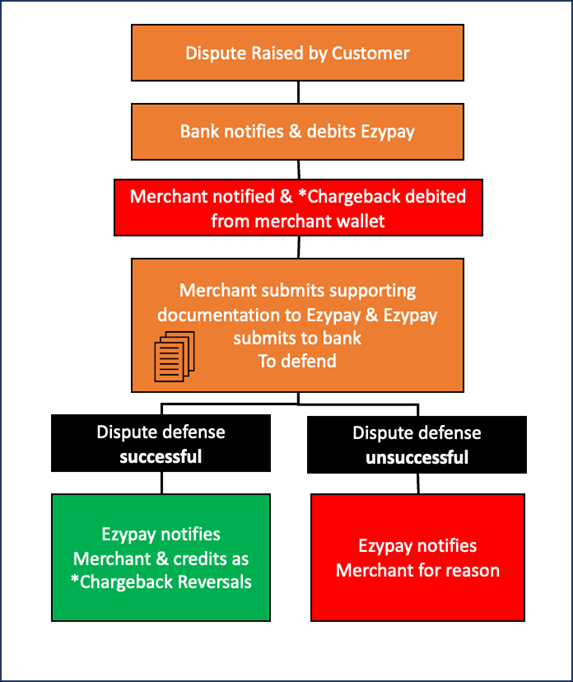

Below is the dispute process flow:

Reasons for a Chargeback

A customer might dispute a payment made against their card because:

- The customer does not recognise what the debited payment was for.

- The customer does not recognise who the merchant is.

- The amount charged to their account was incorrect. This could also be that the customer was unaware of any additional fees that were associated with their payment. (E.g Ezypay fees, merchant fees, etc)

- There were duplicate transactions made on the customer's account.

- The customer was dissatisfied with their purchase (goods or services not as described).

- The customer did not receive their goods or services.

- The customer had cancelled recurring payments but payments are still being debited.

- The customer feels that the debited payment was unauthorized or fraudulent activity.

Ways to Reduce Chargebacks

Customer disputes are inevitable when operating a business, but in most cases, they occur when there is a lack of transparency about a payment plan and the associated fees. There are a few ways you can ensure clarity and minimise the disputes:

- Inform the customer that Ezypay is your billing provider

- Be upfront about the cost of the goods or services. Remove any hidden costs.

- Be clear about customer-paid Set-Up Fees or Transaction Fees

- Ensure the person paying has consented to the payment

- Keep track of goods or services provided to the customer, the time/date of delivery and the cost

As part of the integration process Ezypay has requested for 7 mandatory items to be covered. This includes the 'Acceptance of Ezypay's Terms and Conditions' and 'Providing the correct DDR service template'. These mandatory items have been included to ensure that a customer understands and acknowledges debits will be debited from their accounts. These can be used as supporting evidence for chargeback disputes.

For more details on how to implement these mandatory items: https://developer.ezypay.com/docs/mandatory-items

It is important that the partners capture these details to show that a customer has acknowledged and agreed to what they have signed up for. This documentation needs to be easily accessible to the merchants when required, so that they can present documentation in the case of a dispute.

Examples of Documentation that is Required for a Chargeback

When it comes to handling disputes, the more information that we can provide, the better your case outcome will likely be. Typically, the following documentation will be requested by the bank and can increase the chances in successfully defending a case.

| Evidence Required by Bank | Example Documentation |

|---|---|

| A screenshot/copy of the truncated card number supplied for their agreement | Signed Direct Debit Authority form |

| A screenshot/copy of `click to accept´ that the cardholder agreed to merchant’s T&Cs | Signed Membership Agreement form |

| A screenshot/copy of the cardholder`s access/login | Screenshot of system indicating customer has accessed the merchant’s facility (in the case of a fitness studio, for instance) or proof customer has attended online training (in the case of online training) |

| Documentation showing proof that that the service was provided to the cardholder | Confirmation e-mail or copy of invoice that describes the services provided to customer |

| A screenshot/copy of credit/refund if already processed by the merchant | Copy of refund issued via cash or cheque |

| The start date of when the card/account holder started to use the service | Signed Agreement form |

| Any evidence that card/account holder used the service before | Copy of agreements, invoices or receipts |

| A record of previous non-disputed payment | A list of transactions that has taken place from the customer |

A partner should consider that the above documentation/evidence is readily available and easily accessible to their merchants in their software for such case.

In the integration process Ezypay has the option for integrators to use:

1. Ezypay's hosted payment page

A hosted payment page form where the terms and conditions are displayed and a customer can acknowledge that they have accepted the Ezypay Terms and Conditions.2. Ezypay's welcome email

Upon successful sign-up, Ezypay will send a welcome email with the Terms and Conditions to the customer.Details on on how to implement the 2 options above can be found in our guides below:

https://developer.ezypay.com/docs/mandatory-items

https://developer.ezypay.com/docs/hosted-payment-page

The Chargeback Process

- Ezypay will receive notification from the banking institution that a customer has questioned or disputed a payment with their banking institution.

- Ezypay will deduct the disputed amount (including any fees) from the merchant's next available settlement.

- The partner will need to make sure that the invoice has been marked as

invoice_past_duewithcredit_note_createdso that merchants are aware that there is a chargeback for their customer. - Ezypay will contact the merchant via email for supporting evidence. This can be any documentation to show that a customer has agreed to or signed for debits to be processed against their account (e.g Direct debit request form, etc). The merchant is required to respond and provide Ezypay with supporting documentation via email.

- Once all details have been collaborated, Ezypay will send (via email) the details, along with the supporting evidence back to the banking institution.

- The banking institution will contact Ezypay on the result of the chargeback.

- Ezypay will update the merchant on the outcome of the chargeback.

It is important that the merchant responds to Ezypay with the supporting documentation/ evidence in a timely manner. Ezypay only has a specific time frame (the time frame varies from banking institutions) to help merchants defend the chargeback case.

Without any supporting documentation/evidence, the banking institution will process the chargeback for the customer. Once the bank processes the chargeback, Ezypay will deduct the chargeback amount from the merchant's upcoming settlement, and the partner will need to update the invoice to a failed payment so that merchants are aware of this.

Outcomes of a Chargeback

| Outcome | What Happens Next | Current Invoice Status | Updated Invoice Status |

|---|---|---|---|

| When chargeback has been received | Ezypay will deduct the disputed amount (including any fees) from the merchant's next available settlement. | invoice_paid | invoice_past_duecredit_note_created |

| Merchant Wins the Chargeback | No action is required transactions will continue as normal. Ezypay will credit the merchant the disputed amount that was previously deducted in the next available settlement. * The invoice will no longer be marked as failed. | invoice_past_duecredit_note_created | invoice_paidcredit_note_paid |

| Merchant Loses the Chargeback (In the case of successful chargeback) | The bank will refund the customer for the disputed transaction amount. The invoice will remain as invoice_past_due.* Merchants to follow this up with their customer, and no further transactions will be processed until the chargeback has been resolved between the merchant and the customer. | invoice_past_duecredit_note_created | invoice_past_duecredit_note_failed |

It is important that partners use the following webhooks to update the customer's invoice status so that merchants are aware of the chargeback outcome for their customers:

invoice_past_dueinvoice_paidcredit_note_createdcredit_note_paidcredit_note_failed

Chargeback process from an Advanced Settlement

When there is a request for a chargeback issued by the customer, Ezypay will proceed to update the PAID invoice to a "PAST_DUE" invoice. There will be a credit note that will be created for this chargeback request tying it to the invoice that was disputed.

Example of how changes will occur when a chargeback occurs can be found here.

How chargebacks will be handled in Ezypay (when its an advance settlement scenario):

- Ezypay will go through the standard process as mentioned here.

- Due to the payment would have most probably been distributed to the requestor's wallet, Ezypay will deduct the chargeback amount from merchant. It will then be up to the merchant to recover the funds from either the requestor or the customer directly.

Extra information:

Depending of the risk that comes with the merchant business model, Ezypay might request for a holding amount to be collected in advance before the merchant account is activated.

Updated over 1 year ago